Your Fur Baby’s Ticket to Health and Happiness Without Breaking the Bank

We all want the best for our pets—they’re not just animals; they’re family. But when it comes to their healthcare, the costs can quickly spiral out of control. Whether it's an unexpected emergency or routine care, pet insurance could be the safety net that keeps both your furry friend and your finances in good shape. Let’s explore the ins and outs of pet insurance with real-life stories, practical advice, and clear solutions to help you navigate this vital decision.

I.“How Do I Choose the Right Policy?”Match Your Coverage to Your Pet’s Needs.

Not all insurance plans are created equal. To pick the best one, consider your pet’s age, breed, and typical health risks.

Younger Pets: Focus on comprehensive plans that include accident and illness coverage. These tend to be more affordable when your pet is young and healthy. Senior Pets: Look for policies with fewer exclusions for pre-existing conditions or chronic illnesses.

Lucy, a 3-year-old French Bulldog, had her policy tailored for breed-specific conditions like respiratory issues. When Lucy developed brachycephalic airway syndrome, her insurance covered 90% of the $4,500 surgery, leaving her owner with just a manageable $450 bill.

Pro Tip: Research providers thoroughly—check customer reviews, reimbursement policies, and whether they offer coverage for hereditary conditions. Tools like PetInsuranceReview.com can be lifesavers for comparing plans.

II. “Insurance Costs Too Much!” Pet insurance might feel like an extra expense, but skipping it could cost far more.

The average annual vet bill is $500–$1,000 for routine care alone.

Emergency procedures, such as surgeries or treatments for illnesses, can easily exceed $5,000–$10,000.

When Toby, a 6-year-old Labrador, ruptured his ACL during a game of fetch, the surgery cost $7,200. Toby’s owner, Carla, had chosen a plan with a $50 monthly premium and a $250 deductible. Over the years, Carla had paid around $1,800 for the policy, which saved her nearly $6,000 on this one procedure.

III.3. “Is It Really Worth It? My Vet Says I’m a Responsible Pet Parent.” True, but Accidents Don’t Wait for Responsibility.

You might think regular check-ups and careful supervision are enough to keep your pet healthy. But accidents and unexpected illnesses can happen to even the most well-cared-for pets.

The Curious Cat: Max, a playful 2-year-old tabby, swallowed a rubber band. The foreign object caused intestinal blockage, requiring immediate surgery. The bill? $4,300. His pet insurance covered 85% of the cost.

The Adventurous Dog: Molly, a Golden Retriever, injured herself chasing squirrels, leading to $2,000 in X-rays and treatments. With pet insurance, Molly’s owner only paid $300 out of pocket.

Solution: Opt for a policy with accident coverage if you have an active or curious pet prone to mischief.

IV.“What About Pre-Existing Conditions?” Don’t Let Them Deter You Or Does It?

A common misconception is that pre-existing conditions make pet insurance worthless. While most plans exclude existing conditions, many still cover unrelated health issues or offer accident-only coverage.

Bailey, an 8-year-old Poodle, had arthritis, a pre-existing condition. However, her insurance covered a subsequent diagnosis of diabetes, including insulin, vet visits, and blood tests. The annual cost of managing diabetes—around $1,200—was reduced to just $240 thanks to her policy.

Pro Tip: Enroll pets while they’re young and healthy to avoid exclusions for pre-existing conditions.

Trends in Pet Insurance to Watch For

Telehealth Coverage: Many policies now include virtual consultations with veterinarians, perfect for minor health concerns.

Preventive Care Plans: Some insurers cover wellness expenses, like flea/tick treatments, vaccines, and annual exams, as part of their policies.

Alternative Therapies: Increasingly, policies are offering coverage for treatments like acupuncture or physical therapy for pets with chronic conditions or injuries.

Multi-Pet Discounts: If you’re a proud parent of multiple pets, look for insurers offering bundle discounts.

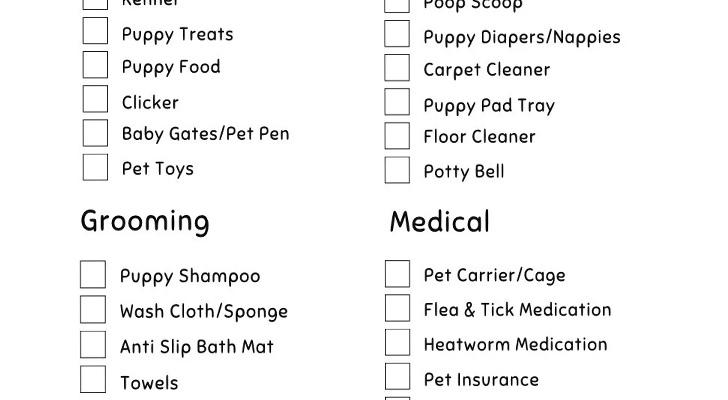

How to Get Started: A Practical Checklist.

Research Providers: Look for well-rated companies with transparent reimbursement practices.

Understand Your Policy: Carefully review the fine print for exclusions, waiting periods, and coverage caps.

Balance Cost and Coverage: Consider your budget but avoid cutting corners—cheap premiums often mean limited benefits.

Ask for Recommendations: Your vet or fellow pet owners can share valuable insights.

Give Your Pet the Gift of Protection

Your pet relies on you for everything—from belly rubs to their health and safety. Pet insurance isn’t just a financial decision; it’s an investment in your pet’s well-being. It ensures that when life throws you a curveball, you’re ready to catch it without compromising their care—or your wallet.

It’s a rambunctious puppy or a wise old kitty, take the step to secure their future. After all, your fur babies give you their unconditional love.